Southeast Asia Household Appliances Market Size, Growth, Analysis & Forecast Report, 2033 | UnivDatos

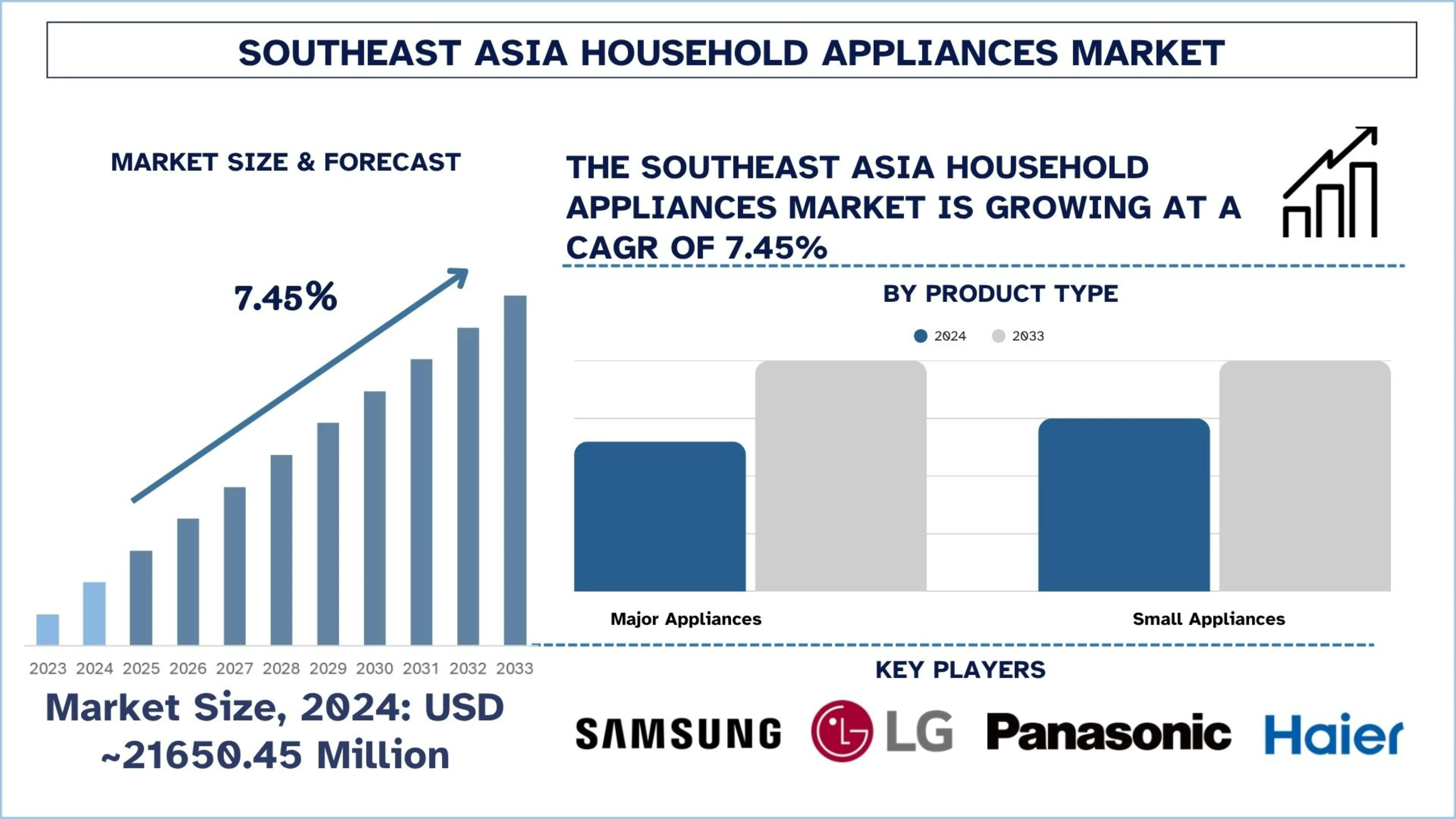

According to a new report by UnivDatos, the Southeast Asia Household Appliances Market is expected to reach USD Million in 2033 by growing at a CAGR of 7.45% during the forecast period (2025- 2033F). This is mainly due to the rapid urbanization, a growing middle-income population, and an increase in the use of smart and connected home appliances. Additionally, the region's warm weather conditions are driving high demand for cooling appliances. Furthermore, government-associated campaigns to reduce energy consumption and promote local production are further stimulating growth in the industry. Moreover, the rising expansion of companies in manufacturing or research and development drives the market.

For example, on August 27, 2025, Panasonic R&D Center Singapore (PRDCSG) announced the opening of its new “Innovation Hub” at the Punggol Digital District (PDD). This space is Panasonic’s flagship innovation hub in Singapore and Southeast Asia, dedicated to developing and testing AI-powered smart building technologies and robotics solutions.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/southeast-asia-household-appliances-market?popup=report-enquiry

Driver: Smart Home Adoption

The adoption of smart homes is a significant growth driver in the Southeast Asian market for household appliances. Smart refrigerators, air conditioners, and washing machines, among other products, can be monitored remotely through mobile applications, enabling more effective home maintenance. Furthermore, the growing interest in home automation among middle-class households in cities, the proliferation of low-cost smart devices, and increasing awareness of IoT technology all contribute to the strengthening of this trend. Therefore, companies are accelerating the development and commercialization of intelligent, integrated solutions to meet the growing demand.

On June 23, 2025, Xiaomi officially unveiled its latest lineup of AI-powered smart appliances, signaling a deeper expansion into the Internet of Things (IoT) market across Southeast Asia. During an event held at the Queen Sirikit National Convention Center, the company launched three new appliances: the Mijia Air Conditioner Pro Eco Inverter, a smart refrigerator with “fresh convertible zones,” and a front-load washer-dryer with intelligent drying detection.

Segments that transform the industry

- Based on product type, the market is segmented into major appliances (refrigerators, washing machines, air conditioners, dishwashing machines, others), small appliances (coffee makers, air purifiers, cookers & steamers, personal care appliances, others). Among these, the major household appliances market held the dominant share of the household appliances market in 2024, driven by the increasing number of housing projects, urbanization, and improved living standards, which are driving consistent demand among middle-income households. Also, companies are capitalizing on this trend by introducing energy-efficient and smart options that appeal to environmentally conscious consumers. The modernization and home automation trends further consolidate the segment's impact on overall market growth. On June 9, 2025, Guangdong TCL Smart Home Appliances Co., Ltd. announced plans to invest RMB 680 million (~USD 95.2 million) in Thailand, with Two-Phase Construction of Freezer and Refrigerator Production Lines.

Region that transforms the industry

- Vietnam is expected to grow at a significant CAGR during the forecast period (2025-2033), which is driven by rapid industrialization, a rise in the middle-class population, and growing disposable income, leading to high consumer demand for modern home solutions. The development of a manufacturing base in the country, combined with foreign investments, is making affordable and locally assembled appliances available in accordance with regional preferences. Moreover, the adoption of e-commerce and digital payments is also making appliances more accessible to a wider audience, which drives the market in Vietnam. On November 5, 2024, LG Electronics (LG) strengthened its research and development (R&D) capabilities in Vietnam, expanding its local research program into areas including vehicle components, the webOS platform, and home appliances. In 2024, LG’s Vietnamese R&D subsidiary, LG Electronics Development Vietnam (LGEDV), integrated living, kitchen, and air solutions – all considered core products – into its software development and verification portfolio.

Click here to view the Report Description & TOC https://univdatos.com/reports/southeast-asia-household-appliances-market

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis of By Product Type, By Distribution Channel, by Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Related Report:-

India Smart TV Market: Current Analysis and Forecast (2025-2033)

MENA Smart Home Appliances Market: Current Analysis and Forecast (2023-2030)

Smart Home Market: Current Analysis and Forecast (2022-2028)

Middle East Smart Homes Devices Market: Current Analysis and Forecast (2023-2030)

Asia-Pacific Smart Homes Technology Market: Current Analysis and Forecast (2019-2025)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/