Emerging Patterns in iPaaS Adoption

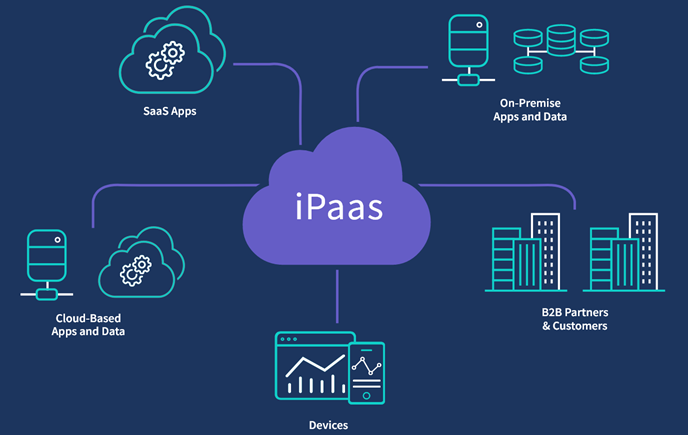

The United States enterprise technology landscape is undergoing a fundamental re-architecting, with a sophisticated cloud-based middleware layer at its very center. This transformation is a core component of the global Ipaas Trends and represents a strategic response to the massive challenge of digital fragmentation. The modern American enterprise no longer operates on a handful of monolithic, on-premise systems. Instead, it relies on a sprawling and ever-growing ecosystem of hundreds of best-of-breed Software-as-a-Service (SaaS) applications, from Salesforce for CRM to Workday for HR and Slack for communication. While this provides immense functional benefits, it creates a critical problem: valuable business data becomes trapped in isolated silos, making it impossible to achieve a unified view of the customer or to automate business processes that span multiple departments. Integration Platform as a Service (iPaaS) has emerged as the essential "digital glue" to solve this modern integration crisis. It provides a cloud-based platform with a suite of tools for building, deploying, and managing integrations between disparate applications and data sources, enabling a seamless and real-time flow of information across the enterprise. For US businesses, which are at the forefront of SaaS adoption, iPaaS has become the indispensable central nervous system of the connected, digital enterprise.

Key Players

The key players shaping the US iPaaS market are a powerful and diverse group of technology vendors, each with a distinct strategic approach. The first group consists of the pure-play, cloud-native iPaaS pioneers who effectively created the market. This includes companies like Boomi and Workato, who have built their entire businesses on providing a comprehensive, vendor-agnostic platform with a vast library of pre-built connectors and a low-code interface designed to serve both professional IT developers and less-technical "citizen integrators." The second, and increasingly dominant, group are the major enterprise application and cloud platform giants. Salesforce, with its multi-billion-dollar acquisition of MuleSoft, is a major key player, using integration as a strategic tool to make its core CRM platform the central hub of the customer data ecosystem. The major cloud hyperscalers—AWS, Microsoft, and Google—are also key players, offering their own suites of native integration services (like Azure Logic Apps and AWS Step Functions) that are deeply embedded into their cloud platforms, providing a low-friction option for their millions of customers. A third group consists of the major ERP vendors like SAP and Oracle, who have built out their own integration platforms to help their massive installed base of enterprise customers connect their legacy on-premise systems to the cloud.

Future in "iPaaS Trends"

The future of iPaaS trends in the United States will be defined by a significant expansion of the platform's capabilities, moving far beyond simple application and data integration. The next major phase of evolution is the deep convergence of iPaaS with other automation technologies, a trend known as "hyperautomation." The leading iPaaS platforms are no longer just connecting APIs; they are integrating Robotic Process Automation (RPA) to automate tasks in legacy systems that don't have APIs, and Business Process Management (BPM) to orchestrate complex, long-running workflows that involve human decision-making. A second major future trend is the infusion of artificial intelligence and machine learning into the core of the integration platform. This "intelligent iPaaS" will use AI to automatically suggest data mappings, to predict and proactively resolve integration errors, and to embed intelligent decision-making directly into the integration flows themselves. The future is an iPaaS that doesn't just move data, but also understands and acts upon it. This level of automation and intelligence is being most aggressively pursued in the highly competitive US market, placing it far ahead of the current state of adoption in emerging markets like South America or MEA. The future is about creating a single, unified platform for all enterprise integration and automation needs.

Key Points "iPaaS Trends"

This strategic overview highlights several crucial points about the US iPaaS market. First, the primary driver is the explosion of SaaS applications in the American enterprise, which has created a massive and urgent need for a scalable integration solution. Second, the key players are a competitive mix of pure-play specialists, the major cloud and application platform giants who have either built or bought their way into the market, and the ERP incumbents. Third, the future of the market is a strategic expansion from simple integration to a comprehensive "hyperautomation" platform, deeply infused with artificial intelligence. Finally, the US market is the global epicenter of iPaaS innovation and adoption, with the trends and competitive dynamics here setting the stage for the rest of the world. The US is not just the largest market; it is the market that is defining the future of enterprise connectivity. The Ipaas Trends is projected to grow to USD 211.36 Billion by 2035, exhibiting a CAGR of 28.87% during the forecast period 2025-2035.

Top Trending Reports -

Brazil White Box Server Industry