3D Printing Filament Market Size, Share, Growth Forecast, Trends & Segment Analysis

The 3D printing filament market covers the range of polymer-based feedstocks used in fused filament fabrication (FFF/FDM) and other extrusion-based additive-manufacturing processes. Filaments—available in thermoplastics, composites, and specialty polymers—are essential to rapid prototyping, small-batch production, and emerging end-use manufacturing across automotive, aerospace, healthcare, education, consumer products, and tooling sectors.

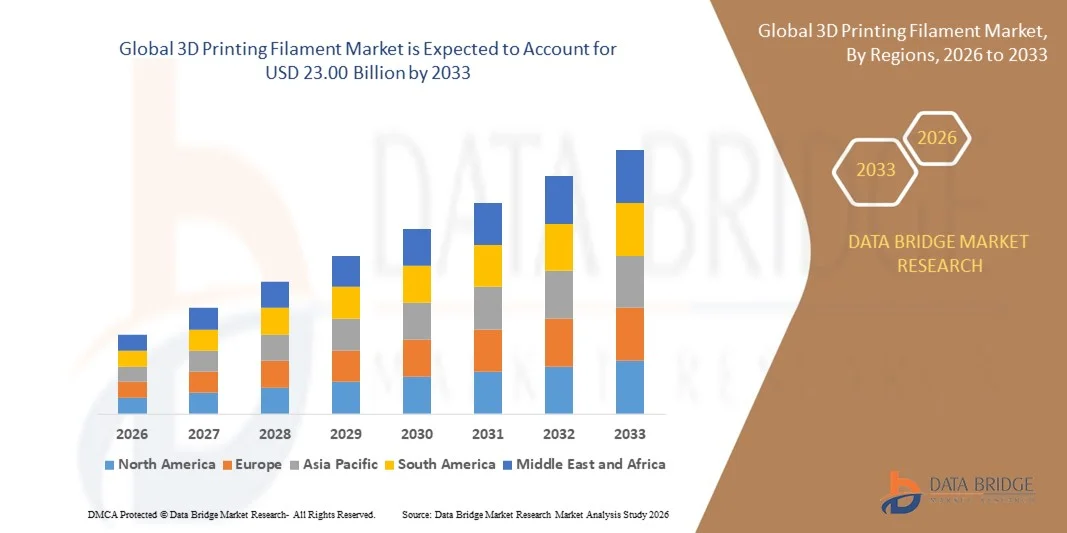

The global 3D printing filament market size was valued at USD 3.17 billion in 2025 and is expected to reach USD 23.00 billion by 2033, at a CAGR of 28.10% during the forecast period

Market Overview

Advances in desktop and industrial 3D printers, the shift from prototyping to production, and a growing ecosystem of material innovators have expanded filament demand. Key market movements include quality standardization, the rise of engineered and composite filaments, more color/finish choices, and broader adoption in functional and regulatory-sensitive applications (e.g., medical devices, end-use automotive parts).

Key Growth Drivers

-

Wider Adoption of Additive Manufacturing in Production — Manufacturers are increasingly using FFF for jigs, fixtures, end-use parts, and low-volume production, boosting demand for performance filaments.

-

Material Innovation — Development of high-performance thermoplastics (PEEK, Ultem/PEI), filled filaments (carbon fiber, glass, metal powders), and flexible elastomers expands application space.

-

Declining Equipment & Material Costs — More affordable desktop and prosumer printers and improved filament supply chains lower entry barriers for SMEs, educational institutions, and hobbyists.

-

Customization & On-Demand Manufacturing — Rapid iteration, customization, and local manufacturing needs support diverse filament portfolios and small-batch specialty grades.

-

Sustainability Focus — Growth of recycled filaments and bio-based polymers addresses circularity concerns in consumer and industrial markets.

Product & Technology Segmentation

By Material Type

-

PLA (Polylactic Acid) — Beginner-friendly, biodegradable, high demand in education and prototyping.

-

ABS (Acrylonitrile Butadiene Styrene) — Tough, temperature-resistant; common in industrial prototyping.

-

PETG / PET — Good chemical resistance and toughness for functional parts.

-

Nylon (PA) — High strength, wear resistance; used for functional and mechanical components.

-

TPU / TPE (Flexible Elastomers) — Flexible, used for seals, grips, and wearable parts.

-

High-performance Polymers (PEEK, PEI/Ultem) — Aerospace, medical-grade, high-temperature applications.

-

Composite & Filled Filaments — Carbon-fiber-, glass-, metal- or ceramic-filled filaments for increased stiffness, thermal properties or aesthetic finishes.

-

Recycled & Bio-based Filaments — Sustainability-oriented grades for consumer and packaging-adjacent use.

By Formulation / Grade

-

Standard / General-Purpose Filaments

-

Engineering-Grade Filaments

-

Medical-Grade / Food-Contact Grade Filaments

-

Specialty / Aesthetic Filaments (wood-look, metallic, glow-in-the-dark)

By Application

-

Prototyping & Product Development

-

Tooling, Jigs & Fixtures

-

End-Use Production Parts (Low-Volume Manufacturing)

-

Medical Devices & Orthotics

-

Automotive Components & Customization

-

Aerospace Non-Structural Components

-

Education, Makerspaces & Consumer Hobbyist Use

By End-User

-

Industrial & Manufacturing

-

Healthcare & Medical Labs

-

Automotive & Aerospace OEMs and Tier Suppliers

-

Education & Research Institutions

-

Consumer & Hobbyist Markets

-

Service Bureaus & On-Demand Manufacturers

Regional Dynamics

-

North America: Strong R&D, high adoption in aerospace and healthcare, numerous filament innovators and suppliers.

-

Europe: Focus on industrial-grade materials, sustainability, and regulatory-compliant medical/food-contact filaments.

-

Asia-Pacific: Rapid manufacturing adoption, large consumer/hobbyist base, significant filament production capacity.

-

Rest of World: Emerging adoption via service bureaus, education programs, and growing local supply chains.

Competitive Landscape

Market players range from commodity filament manufacturers and brand-name polymer suppliers to specialized material innovators producing engineered and composite grades. Differentiation centers on material performance, filament tolerances and consistency, color/finish variety, certified grades (medical, food-contact), supply reliability, and technical support for printer-material integration.

Challenges

-

Quality Consistency & Tolerances: Diameter variation, moisture sensitivity, and inconsistent additives can cause print failures.

-

Material Certification & Regulatory Barriers: Medical and aerospace applications require validated, certified filaments and traceable supply chains.

-

Intellectual Property & Counterfeits: Third-party and counterfeit filaments can erode trust and damage printers.

-

Sustainability Pressure: End-of-life filament waste and reliance on petrochemical feedstocks draw scrutiny from eco-conscious buyers.

-

Printer-Material Compatibility: Achieving reliable results across diverse printer models requires tight collaboration between filament makers and printer OEMs.

Opportunities & Trends

-

Shift to Engineered & Composite Filaments: As additive manufacturing moves into functional parts, demand for high-strength, temperature-resistant, and electrically conductive filaments will rise.

-

Material Ecosystem Partnerships: Co-developed filament/printer profiles, certification kits, and validated workflows reduce adoption friction for industrial users.

-

Recycled & Bio-Based Feedstocks: Circular-economy filament products and closed-loop recycling programs for failed prints will attract sustainability-minded customers.

-

On-Demand & Localized Material Supply: Regional filament manufacturing reduces lead time and logistics costs for service bureaus and industrial users.

-

Color, Finish & Specialty Aesthetics: Premium consumer and design markets will drive demand for novel finishes and specialty blends.

Future Outlook

The 3D printing filament market is poised for continued expansion driven by industrialization of additive manufacturing, material innovation, and growing use in functional, certified applications. Expect faster growth in engineering-grade and specialty filaments compared with commodity grades, with particular momentum in composites, high-temperature polymers, and certified medical/aerospace materials. Sustainability initiatives and local production models will further shape supplier strategies over the next 5–10 years.

Browse More Reports:

Global Stretch Blow Molding Machine Market

Global Plant Activators Market

Global Lecithin and Phospholipids Market

Global Circular Liquid Crystal Polymer Connector (LCP) Market

Global Insect Repellent Market

Global Ovarian Cancer Diagnostics Market

Global Plasma Protease C1-inhibitor Market

Global AI-Driven Pathology Tools Market

Global AI-Powered Prosthetics Market

Global Air Runner Market

Global Aliphatic Hydrocarbon Solvents and Thinners Market

Global Aneurysmal Subarachnoid Hemorrhage Market

Global Antimycotic Drugs Market

Global Auriculo-Condylar Syndrome Market

Global Automotive Stabilizer Bar Link Market

Conclusion

Filaments are the material backbone of extrusion-based additive manufacturing. Companies that invest in consistent quality, certified grades, printer compatibility, and sustainable feedstock strategies will capture the premium segment of the market. As additive manufacturing continues its shift from prototyping to production, filament suppliers who partner closely with OEMs and end-users to validate performance will be best positioned for long-term growth.

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com