Global Automotive Trailer Market Share Set to Surge with Logistics Boom

The global Automotive Trailer Market (see full study here: Automotive Trailer Market Share Report) is entering an phase of transformative growth as the dynamics of freight, logistics and commercial transport evolve. Trailers—a seemingly simple extension of trucks—are now becoming increasingly strategic assets thanks to changes in e-commerce, cold-chain requirements, regulatory environments and vehicle-fleet optimisation. As a result, their market share in the overall transport ecosystem is rising, both in unit volumes and in value-chain significance.

What Drives the Rising Market Share

One of the major drivers behind the rising share of the trailer market is the expansion of global logistics and freight movement. With growth in e-commerce, global trade, last-mile delivery and infrastructure development, the demand for efficient, specialised trailers has grown rapidly. Commercial vehicles are increasingly dependent on the right trailer types—from dry-van to flatbed to refrigerated units—to serve differentiated cargo needs. As these trailers become more specialised and higher-value, their share in vehicle and fleet cost structures increases.

Another powerful factor is regulatory and infrastructure pressure. Governments in many regions are tightening regulations around axle loads, vehicle dimensions, weight-limits and emissions for heavy transport. This compels fleet operators to upgrade to modern trailers with advanced designs (tandem/triple‐axle, lightweight materials, telematics). These upgrades enlarge the per‐unit value of trailers and boost the overall market share of trailer equipment.

Key Trends Shaping Market Share

Several noteworthy trends are reshaping how the trailer segment captures value and share:

-

Specialised trailer types: Demand is growing for refrigerated trailers, chemical-and-liquid tankers, tipper/truck-trailers, flatbeds and container chassis. Among them, dry van & box trailers remain high in volume but more specialised units bring higher value.

-

Material and technical innovation: Lightweight materials (aluminium, composites), telematics for tracking and condition monitoring, smart sensors and connectivity are increasingly integrated into trailers. These enhancements raise cost, complexity and value, thereby increasing the share of the market going to advanced trailer systems rather than commodity units.

-

Regional leadership and growth: The Asia-Pacific region leads in volume due to high vehicle production, expanding logistics sectors, infrastructure build-out and manufacturing capability. As this region drives volume growth, its share of the global trailer market expands. Meanwhile, North America and Europe contribute significant value share due to premium trailer features, higher regulation and advanced fleets.

-

Fleet replacement and aftermarket demand: As commercial fleets age and regulatory pressure increases, replacement trailers and retrofit upgrades form a growing portion of the market. This aftermarket growth adds to the total addressable share of the trailer market.

Regional Insights Into Market Share

In geographic terms, Asia-Pacific commands a dominant share of global trailer volumes, supported by strong production bases in China, India and Southeast Asia. The region’s share is bolstered by rapid logistics network expansion, rising vehicle ownership, and the build-out of cold-chain delivery infrastructure. In contrast, Europe and North America hold leading positions in value per trailer, thanks to higher models, stricter regulations, and advanced features. Growth in emerging markets in Latin America, Middle East & Africa is also gaining momentum, which is laying the groundwork for future share expansion globally.

Challenges and Opportunities in Gaining Share

Despite the strong tailwinds, there are challenges that could moderate share growth. Fluctuating raw-material costs (steel, aluminium), regulatory uncertainty in emerging markets, maintenance and operational cost burdens for fleets, and slower uptake of high-tech trailer features are all potential restraints. However, the opportunities are significant: logistics firms seeking efficiency gains, the cold-chain expansion for perishables and pharmaceuticals, the shift to smart trailers with telematics and real-time monitoring, and the trend towards lightweight and modular trailer designs all present major upside. Manufacturers and suppliers that adapt to these trends will capture greater share.

Looking Ahead: Market Share Trajectory

Looking forward, the trailer market’s share within the commercial-vehicle ecosystem is poised to climb. As freight and logistics continue to expand globally and commercial fleets modernise, the demand for more specialised, higher-value trailer units will grow. The share of trailer cost and importance within the overall transport value chain will rise accordingly. For suppliers, manufacturers, fleet operators and investors, this means that aligning with the evolving transporter needs — greater connectivity, lighter materials, higher capacity, regulatory compliance — will be essential to secure higher market share.

In summary, the automotive trailer market is no longer just a support accessory in trucking—it is becoming a strategic component of modern freight mobility. With rising volumes, increasing technological content and regional growth, its market share is expanding both in scale and value. Stakeholders taking proactive positions now will be best placed to capture the next wave of growth in this critical transport segment.

More Related Report

Automotive Radar Applications Market Size

Catégories

Lire la suite

The global light olefins market is experiencing steady growth as industries recognize their indispensable role in producing versatile materials. Light olefins, mainly ethylene and propylene, are essential intermediates in producing polymers such as polyethylene and polypropylene, which dominate applications in packaging, automotive, textiles, and construction. With the rapid expansion of...

"Competitive Analysis of Executive Summary Archery Equipment Market Market Size and Share CAGR Value The global archery equipment market was valued at USD 2.56 billion in 2024 and is expected to reach USD 4.08 billion by 2032. During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.00%, primarily driven by rising popularity...

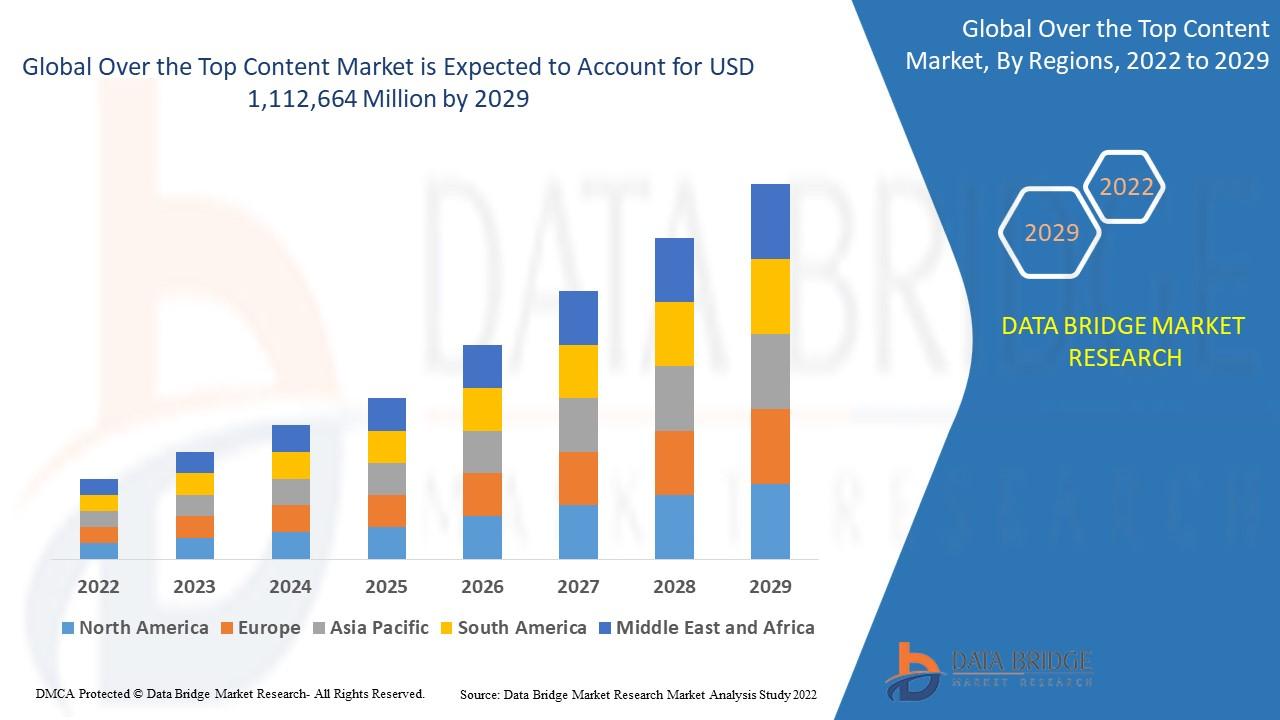

"Executive Summary Over the Top Content Market Market Size and Share Forecast CAGR Value The over the top content market is expected to witness market growth at a rate of 27.65% in the forecast period of 2022 to 2029 and is expected to reach USD 1,112,664 million by 2029. Data Bridge Market Research report on over the top content market provides analysis and insights regarding the...

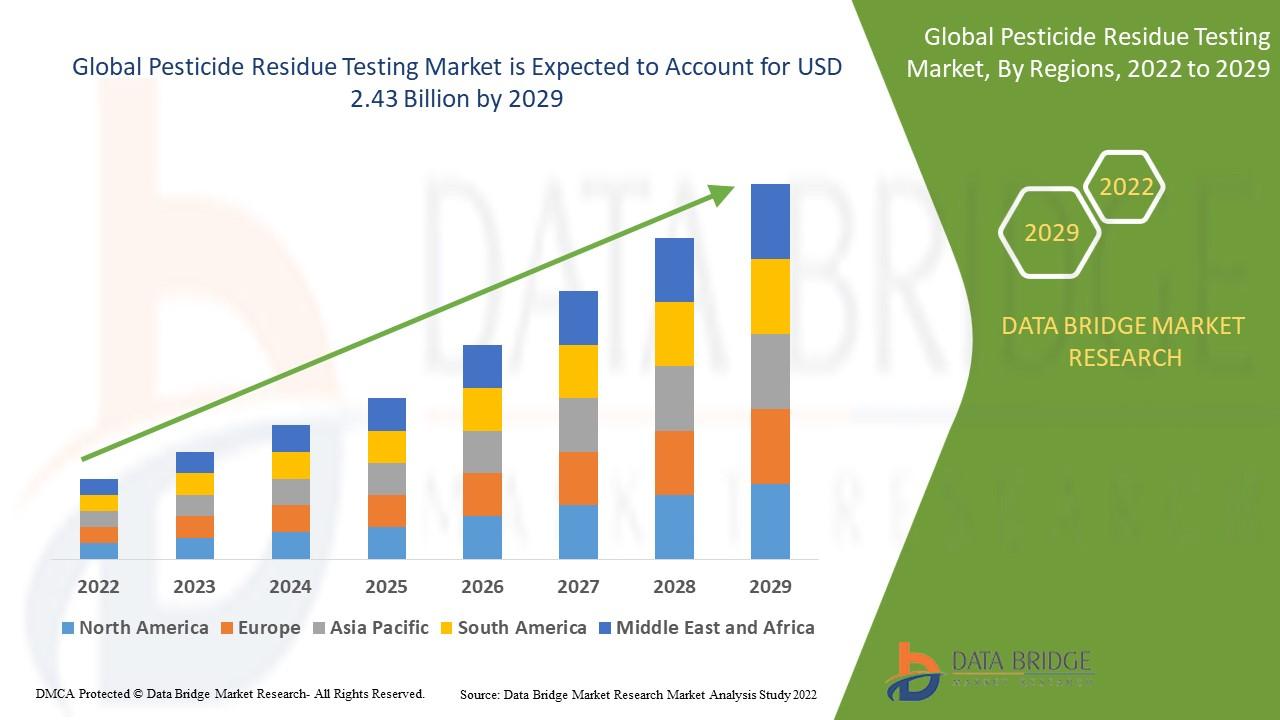

"Executive Summary Pesticide Residue Testing Market Market: Share, Size & Strategic Insights CAGR Value Data Bridge Market Research analyses that the pesticide residue testing market was valued at 1.34 billion in 2021 is expected to reach the value of USD 2.43 billion by 2029, at aw CAGR of 7.70% during the forecast period. The comprehensive Pesticide Residue Testing Market...

Executive Summary Company Secretarial Software Market Trends: Share, Size, and Future Forecast Data Bridge Market Research analyses that the company secretarial software market is expected to reach USD 8.54 billion by 2030, which is USD 5.48 billion in 2022, at a CAGR of 5.70% during the forecast period. By working with a number of steps of collecting and analysing market...