Automotive Connectors Market Size and Demand Outlook Across Major Global Regions

The value of the modern car is increasingly defined by its electronics, and every single one of those electronic features relies on a connector. As of late 2025, the global Automotive Connectors Market Size has swelled into a massive, multi-billion-dollar industry. This valuation is not just a reflection of the number of cars being built, but a direct indicator of their exploding technological complexity. Every new sensor for safety, every new screen for infotainment, and every battery pack for an electric vehicle adds more and higher-value connectors, pushing the market size well beyond the pace of simple vehicle production growth.

Calculating the Market's Value: Beyond Simple Volume

The total market size is the aggregate annual revenue from the sale of all automotive connectors. It can be simplified as:

Market Size ≈ (Total Vehicles Produced) x (Average Connectors per Vehicle) x (Average Price per Connector)

While vehicle production provides a baseline volume, the real story of the market's value comes from the last two factors, which are both increasing dramatically.

-

More Connectors per Vehicle: A basic car from 15 years ago had a limited number of electronic systems. A 2025 vehicle is a rolling network. The proliferation of ADAS sensors, the move to digital cockpits, the addition of numerous comfort and convenience features (power seats, ambient lighting, USB ports), and the complex modules in an EV mean the sheer quantity of connection points per car has soared.

-

Higher Average Price per Connector: This is the most significant value driver. The market is shifting from simple, low-cost connectors to highly complex, specialized, and more expensive ones:

-

High-Voltage (HV) Connectors: A single set of HV connectors for an EV's battery and motor can be worth many times more than dozens of small body electronics connectors.

-

High-Speed Data (HSD) Connectors: Connectors for Automotive Ethernet, LiDAR, radar, and high-resolution displays require precision engineering, shielding, and tight tolerances, commanding a premium price over simple power connectors.

-

Sealed/Waterproof Connectors: The increasing number of sensors located in exposed areas (bumpers, engine bay, underbody) requires robust, sealed connectors (IP67/IP6K9K) that are more expensive to produce.

-

Miniaturized Connectors: Packing more pins into a smaller space (high-density connectors) requires advanced manufacturing and drives up cost.

-

Market Size by Segments (Valuation)

When analyzing the market's value, the segmentation is clear:

-

By Application:

-

Safety & Security: This is one of the highest-value and fastest-growing segments. It includes high-reliability connectors for airbags, ABS, ESC, and the entire suite of ADAS (camera, radar, LiDAR) sensors and ECUs.

-

Powertrain: This segment has been revolutionized by electrification. The high-voltage EV powertrain connector segment (battery, inverter, motor) is now a massive market on its own, rapidly adding to the value of the traditional ICE powertrain (engine, transmission) connector market.

-

Infotainment & Connectivity: Another high-growth, high-value segment, driven by large displays, telematics units, USB-C ports, and antenna connectors (FAKRA).

-

Body & Convenience: This is the largest segment by volume (lights, windows, locks, seats) but consists of lower-cost connectors, contributing a stable base to the overall market size.

-

-

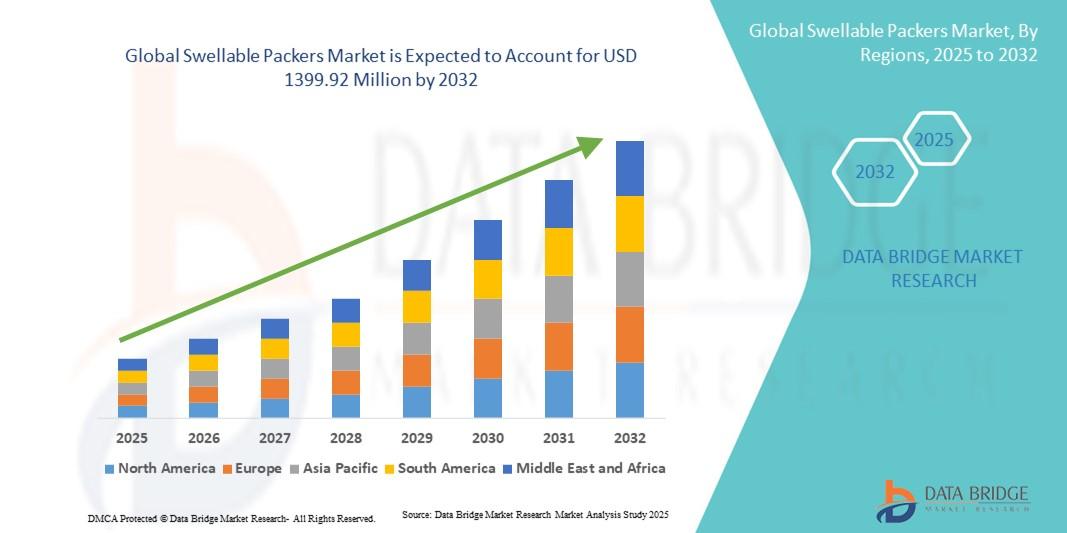

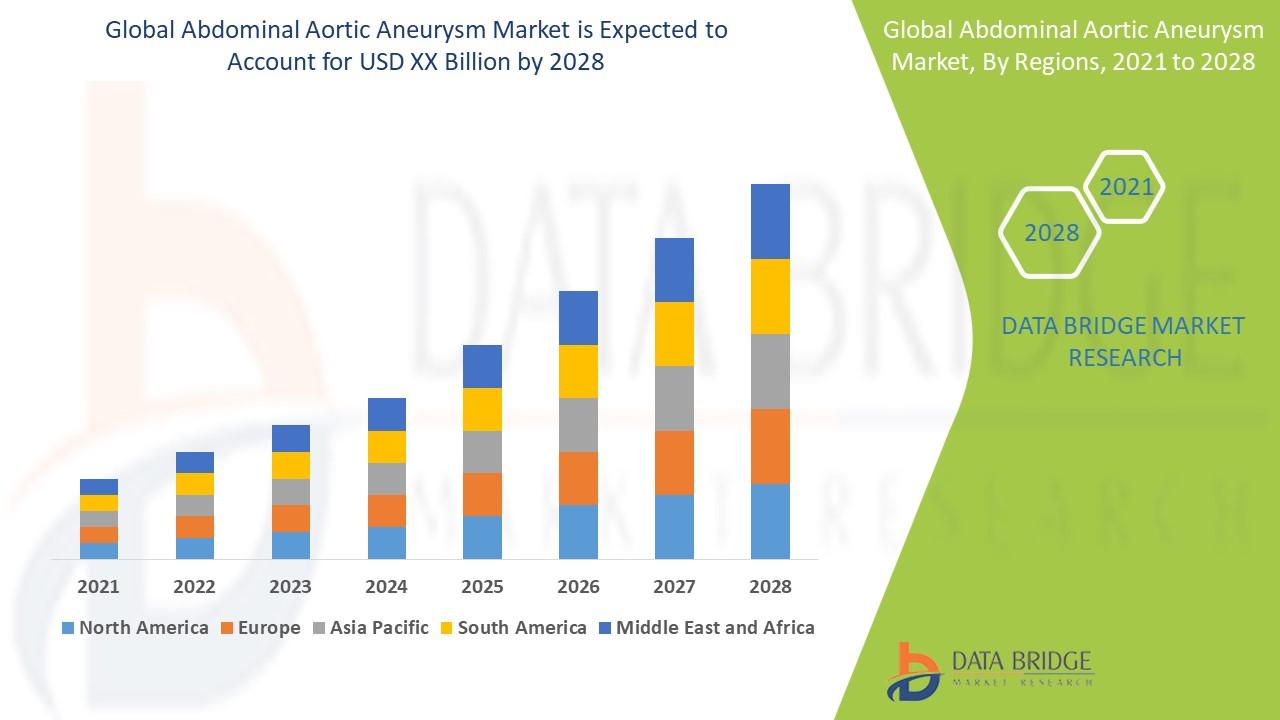

By Region:

-

Asia-Pacific (APAC): The largest market globally, both in terms of production and consumption. This is driven by the sheer scale of automotive manufacturing in China, Japan, South Korea, and the rapidly growing Indian market. China, in particular, with its dominant EV production, is a massive consumer of high-value HV and HSD connectors.

-

Europe: A high-value market driven by premium vehicle production, which has a very high content of advanced electronics, ADAS, and infotainment systems.

-

North America: A large market driven by high volumes of pickup trucks and SUVs, which are also increasingly packed with electronics and safety features.

-

Future Projections The market size is universally projected to continue its strong growth trajectory. The "electronification" of the vehicle is far from over. The ongoing adoption of ADAS towards full autonomy, the global shift to EVs, and the increasing demand for a connected in-cabin experience will continue to fuel the need for more numerous, more complex, and higher-value connectors, ensuring the market's robust expansion for the next decade.

Frequently Asked Questions (FAQ)

Q1: How big is the global automotive connectors market?A1: As of 2025, the global automotive connectors market is a massive industry. Estimates vary by source, but the valuation is consistently placed in the tens of billions of US dollars, often in the $20 billion to $30 billion range, with strong continued growth expected.

Q2: Why is the market's revenue (size) growing faster than car sales?A2: Because the value of the connectors inside each new car is increasing dramatically. The shift to EVs and the addition of ADAS/infotainment features require a greater number of complex, specialized, and expensive connectors (for high voltage, high-speed data, etc.) compared to a basic car from a decade ago.

Q3: Which region is the largest market for automotive connectors?A3: The Asia-Pacific (APAC) region is the largest market globally. This is because it is the world's largest automotive manufacturing hub (led by China, Japan, South Korea, and India) and also the largest end-market for vehicles, especially EVs which are connector-intensive.

Q4: How much more valuable are EV connectors compared to ICE car connectors?A4: While an EV still uses all the basic low-voltage connectors, the addition of the high-voltage (HV) harness and its components (battery, inverter, motor) adds significant cost. The specialized, large-gauge, shielded, and safety-interlocked HV connectors can add hundreds of dollars in value per vehicle, making the total connector set for an EV significantly more valuable than for a comparable ICE car.

More Related Report

Automotive Parts Die Casting Market Size

Automotive Heat Shield Market Size