The Battle for the Shelf: Analyzing OSA Solution Market Share

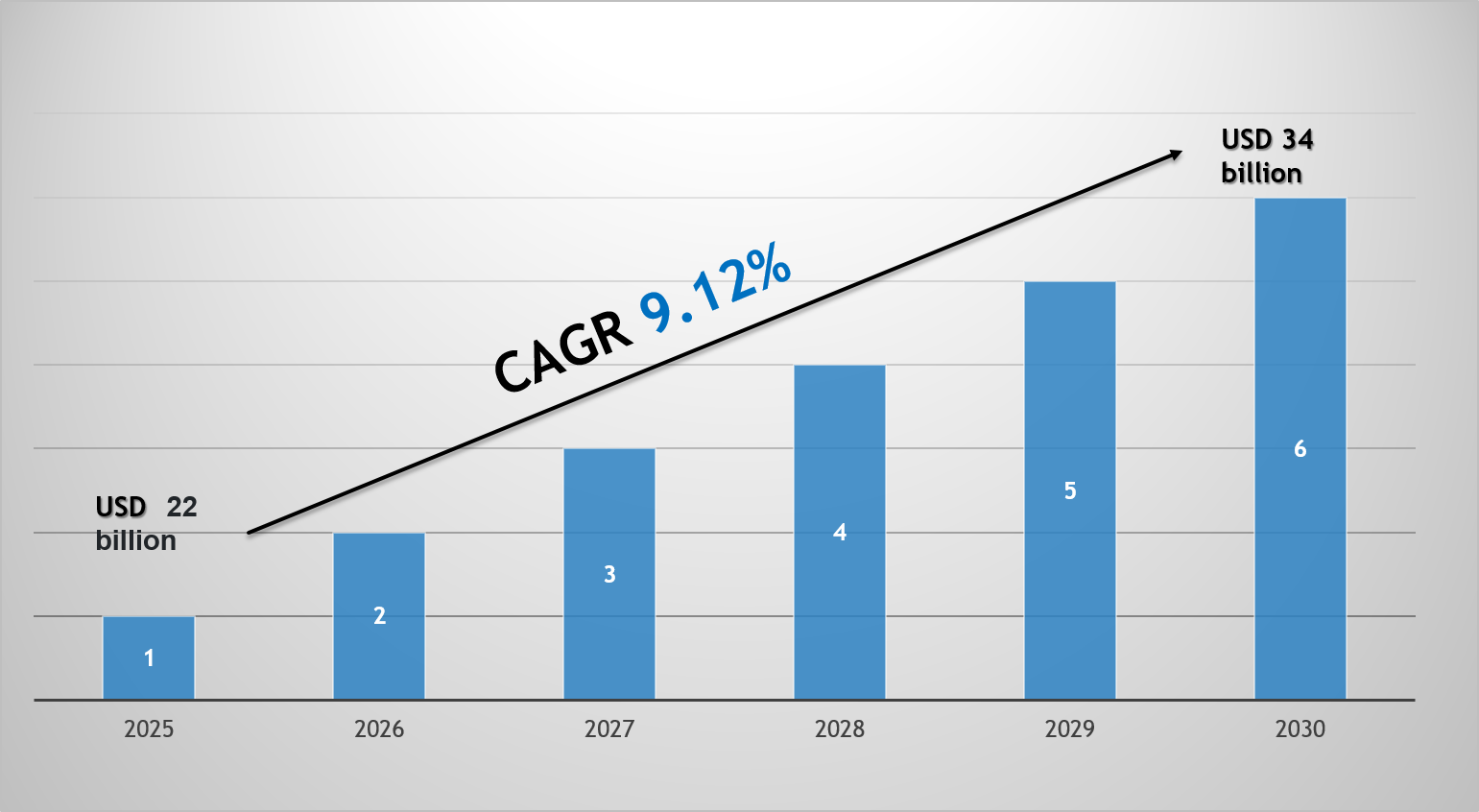

The global competition for On-Shelf Availability Solution Market Share is a dynamic and technology-driven contest between established retail tech players and a new wave of AI-powered startups, all vying to be the leading provider of real-time shelf intelligence. As the overall market continues its strong growth, with a CAGR expected to be around 10.22% from 2025 to 2035, the battle to win contracts with the world's largest retailers and CPG companies is intense. The distribution of market share is being shaped by the accuracy and scalability of the core technology, the ability to provide actionable insights rather than just raw data, and the flexibility to integrate with a retailer's existing systems and workflows, creating a highly competitive and innovative environment.

A significant portion of the market share is held by a group of innovative, venture-backed companies that have pioneered the use of computer vision and AI for shelf monitoring. Companies like Trax and Focal Systems have established a strong position by focusing exclusively on this problem and developing sophisticated image recognition technology. Their strategy often involves deploying their own hardware, such as smart cameras, or leveraging a retailer's existing camera infrastructure. They compete on the basis of the accuracy of their AI models and the richness of the analytics they can provide, not just on out-of-stocks, but on a range of metrics like planogram compliance and share of shelf, making them a powerful tool for both retailers and CPG brands.

Another major segment of the market share is being captured by companies that are focused on robotic automation. Startups like Simbe Robotics and Bossa Nova (though it has pivoted) have developed autonomous robots that can navigate store aisles and use high-resolution cameras to build a detailed, real-time digital map of the store's shelves. Their key value proposition is the ability to achieve near 100% coverage of the store on a frequent basis (e.g., daily) without relying on fixed cameras or human labor. They compete on the basis of the comprehensiveness and frequency of their data capture, providing an incredibly detailed and up-to-date picture of the entire store's inventory status, which is highly valuable for large format retailers like hypermarkets.

The established giants of the retail technology industry are also major players in the market share battle. Companies like Zebra Technologies, which is a leader in mobile computing and barcode scanning, are leveraging their deep relationships with retailers and their massive installed base of handheld devices to offer their own OSA solutions. Their strategy is often to offer a human-centric solution, empowering store associates with smart mobile apps that guide them to out-of-stock locations and streamline the restocking process. They compete on the basis of their deep understanding of in-store workflows and their ability to provide an integrated solution that combines hardware, software, and services from a single, trusted vendor, creating a powerful competitive position against the more niche, AI-focused startups.

Explore Our Latest Trending Reports: