Credit Card Market Scope and Regional Expansion Opportunities

The Credit Card Market scope is vast, projected to grow from USD 1,839.58 Billion in 2025 to USD 2,500 Billion by 2035 at a CAGR of 2.83%. The market encompasses credit cards for retail, corporate, travel, and premium segments, offering various benefits tailored to customer needs.

Technological advancements such as contactless cards, virtual cards, mobile wallet integration, and AI-based security measures expand the market scope by attracting tech-savvy and safety-conscious consumers. Banks are also introducing co-branded and niche cards to target specific demographics.

Consumer adoption is driven by reward programs, cashback offers, and travel incentives. Increasing disposable income and preference for cashless transactions contribute to the widening market scope, providing ample opportunities for growth.

Competitive dynamics include partnerships, acquisitions, and product diversification, which allow companies to expand their market coverage and introduce innovative card types to meet evolving consumer demands. Marketing campaigns emphasizing convenience, rewards, and security further enhance market reach.

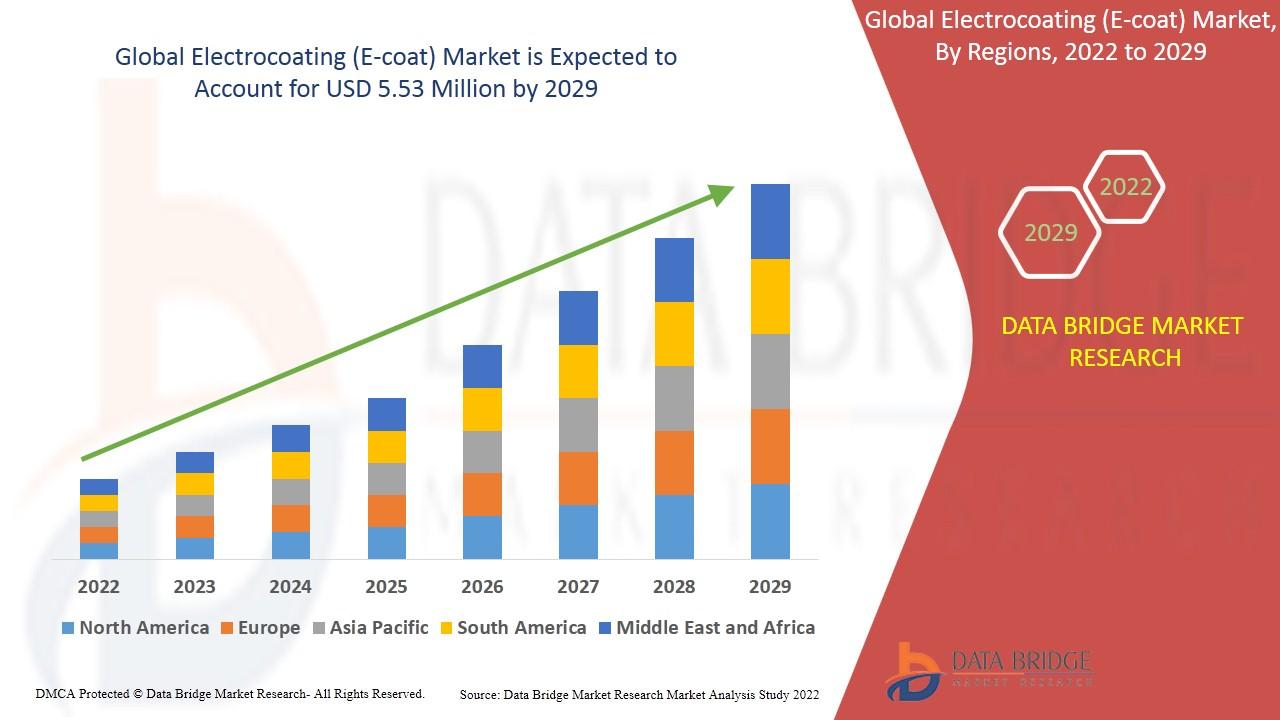

Regionally, North America and Europe dominate the market due to high adoption of digital payments, while Asia-Pacific is rapidly growing due to rising urbanization, smartphone penetration, and increasing middle-class income.

In summary, the Credit Card Market scope is broad, with substantial opportunities for companies focusing on technology, rewards, regional expansion, and personalized solutions.

More Reports: